When it comes to building a credit score most have no idea what it really means. In fact, only 1 in 5 consumers have researched how to increase their score. Beyond the basics, many consumers are still in the dark about what makes their credit scores. Many Consumers do not understand that the credit utilization ratio — the total amount of revolving credit someone uses in a month, compared to the amount of available credit they have — is a major factor in calculating a score.

The most influential factor in determining a credit score is on time monthly payments, which is roughly 35%. Did you know that interest is calculated from the total on the statement date, not the due date? So even if you pay balances in full every month, a card issuer may report a balance resulting in last payments if it goes unnoticed. It’s true that most people are only vaguely aware of the mechanics of a credit score. Most know that the higher your credit score is the better off your chances are to gain approval for credit cards and secure loans. Additionally, higher scores often result lower interest rates.

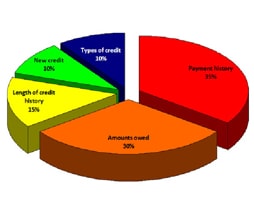

Basically your credit score is nothing more than a value that gives lenders a general idea of your creditworthiness and if they are able trust you with a loan. The general idea is simple, while the algorithms that define it are more difficult to understand. Banks will not only use the score to determine whether or not you receive a loan, but rather what your available credit limit, what terms you’ll have, and what your interest rate will be. Fundamentally, factoring is based on your payment history, your length of credit history, your credit use, the type of credit you use, your recent searches for credit, and more. Pay your debts and debtors, and you credit will reflect just that.

The general idea is simple, while the algorithms that define it are more difficult to understand. Banks will not only use the score to determine whether or not you receive a loan, but rather what your available credit limit, what terms you’ll have, and what your interest rate will be. Fundamentally, factoring is based on your payment history, your length of credit history, your credit use, the type of credit you use, your recent searches for credit, and more. Pay your debts and debtors, and you credit will reflect just that.

There are three credit agencies that handle credit scores – Equifax, TransUnion and Experian. One of the keys to understanding credit scores is to understand that your score could be different with each of these agencies, and that not all lenders use the same agency. To get a better handle on your score and what is influencing it you can request a free credit score from these agencies and then review it. VeteransPlus recommends the following:

Remember:

Where to Get Credit Reports –

Go to: www.annualcreditreport.com to request your reports from Equifax, Transunion, and Experian. You can also call 877-322-8228 to have your reports mailed to you. This service is free. You can request a free copy of each report once a year.

Where to Get Credit Scores –

Go to: www.myfico.com to request FICO scores from your choice of Equifax or Transunion. Each one will cost $19.95 and comes with a full explanation of your credit score and how lenders view you.

You can also go to: www.equifax.com, www.experian.com and www.transunion.com to purchase scores from each agency at a cost of approximately $15.95 each.